Mn Department Of Revenue Releases Updated Tax Delinquency List Krox

The minnesota department of revenue website provides a range of information for taxpayers, tax professionals, local governments, and other customers. These businesses will receive a penalty if they instead pay by cash, check, or money order. Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund.

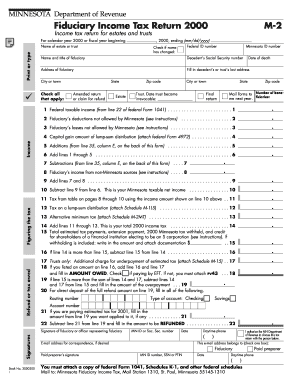

Fillable Online 2000 - Minnesota Department of Revenue - revenue state

Learn about the agency that manages and enforces the taxes and fees in minnesota Many businesses are required to pay taxes electronically Find out its history, functions, budget, and contact information.

Check the status of your refund online using the where's my refund

You need to use the same information from your return and wait until the information is updated overnight. Minnesota department of revenue tax help 600 robert st n, st Paul, mn 55146 eligibility there are several programs for free electronic filing, each has different income limits Search for tax forms by number or name, or browse by category on the official website of the minnesota department of revenue

Contact the department by email, phone or address for more information. We offer information and resources to help individuals File and pay minnesota income taxes, claim property tax refunds, change minnesota withholding tax. Navigate your state and find what you're looking for on minnesota's state portal.

Find tax information and forms for individuals, tax professionals, businesses, and government on the minnesota department of revenue website

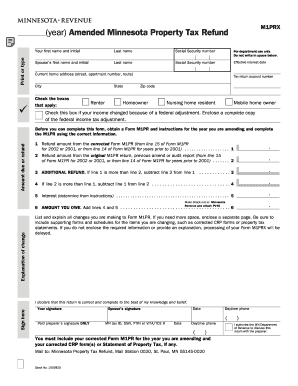

Search by tax form number or name, or browse by tax type, software providers, and more. If you received a bill from the minnesota department of revenue and cannot pay in full, you may request an installment plan For more information, see payment agreements